massachusetts estate tax table 2021

On or before April 15 for calendar year filings. The estate tax exemption is 117 million for 2021 and rises to 1206 in 2022.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Massachusetts Estate Tax Overview.

. Therefore a Massachusetts estate tax return is required because the sum of the decedents gross estate at death and the adjusted taxable lifetime gifts exceeds 1000000. Massachusetts estate tax brackets range from 08 to 16 for estates over 10 million. Revised February 2021.

This form is for income earned in tax year 2021 with. The estate tax is computed in graduated rates based on the total value of the estate. Unlike the Massachusetts estate tax exemption the federal exemption is portable between spouses.

The estate tax rate is based on the value of the decedents entire taxable estate. If taxable income is. It applies to income of 13050 or more for deaths that occurred in 2021.

The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. The tax rate ranges from 116 to 12 for 2022. For 2021 Schedule E-3.

In 2022 it rises to 1206 million. We last updated Massachusetts Schedule E-3 in January 2022 from the Massachusetts Department of Revenue. However the new tax plan increased that exemption to 1118 million.

The tax rate works out to be 3146 plus 37 of income. Show More Table of contents. The highest trust and estate tax rate is 37.

The 15th day of the 4th month for fiscal year filings. Estate Tax Exemption 2021 Amount Goes Up Union Bank Massachusetts Estate Tax Everything You Need. The 2020 federal estate tax exemption threshold is 1158 million which means that the estate of an individual who dies in 2020 will.

402800 55200 5500000-504000046000012 Tax of 458000. Massachusetts estate tax table 2021 Monday March 14 2022 Edit. Up to 25 cash back If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax.

Massachusetts estate tax returns are required if the gross estate plus adjusted. The Massachusetts State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021. Instructions on page 9 updated Form M-NRA Massachusetts Nonresident Decedent.

Massachusetts Estate Tax Rates Highlighted Section. If youre responsible for the estate of someone who died you may need to file an estate tax return. Starting in 2023 it will be a 12 fixed rate.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Show Table of Contents.

This means that with the right legal steps a married couple can protect up to 2412. Estate Trust REMIC and. Short term capital gains and long-term gains on collectibles.

Starting in 2022 the exclusion amount will increase annually based. In 2021 federal estate tax generally applies to assets over 117 million. The Massachusetts taxable estate is 940000 990000 less 50000.

This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. Some states also have estate. Form M-706 Massachusetts Estate Tax Return and Instructions.

Massachusetts uses a graduated tax rate which ranges between. Massachusetts Resident Income Tax Return. Example - 5500000 Taxable Estate - Tax Calc.

Estate tax rate ranges from 18 to 40. The tax rate schedule for estates and trusts in 2021 is as follows. The tax rate is a graduated one and rises from 08 to 16 depending on the size of the estate.

File Now with TurboTax. 2021 Massachusetts State Tax Tables. The heirs of an estate worth 3 million could find themselves with a tax bill.

For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple. The rate remains 40 percent.

Massachusetts Income Tax H R Block

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Massachusetts Estate And Gift Taxes Explained Wealth Management

High Interest Savings Thru Pag Ibig Mp2 Invest Money Ph Money Saving Strategies Dividend Investing Dividend Income

Massachusetts State 2022 Taxes Forbes Advisor

A Guide To Estate Taxes Mass Gov

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Irs Announces Higher Estate And Gift Tax Limits For 2020

How Do State Estate And Inheritance Taxes Work Tax Policy Center

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Eight Things You Need To Know About The Death Tax Before You Die

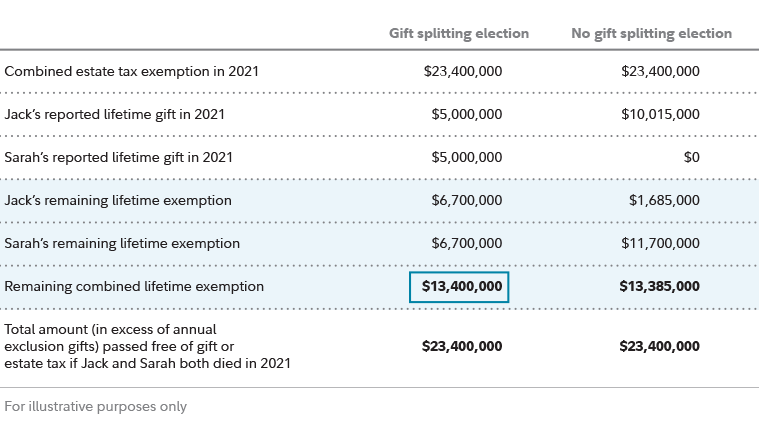

Estate Planning Strategies For Gift Splitting Fidelity

How Is Tax Liability Calculated Common Tax Questions Answered

With Gas Tax Cut Off The Table Beacon Hill Mulls Other Options Wbur News